does binance send tax forms

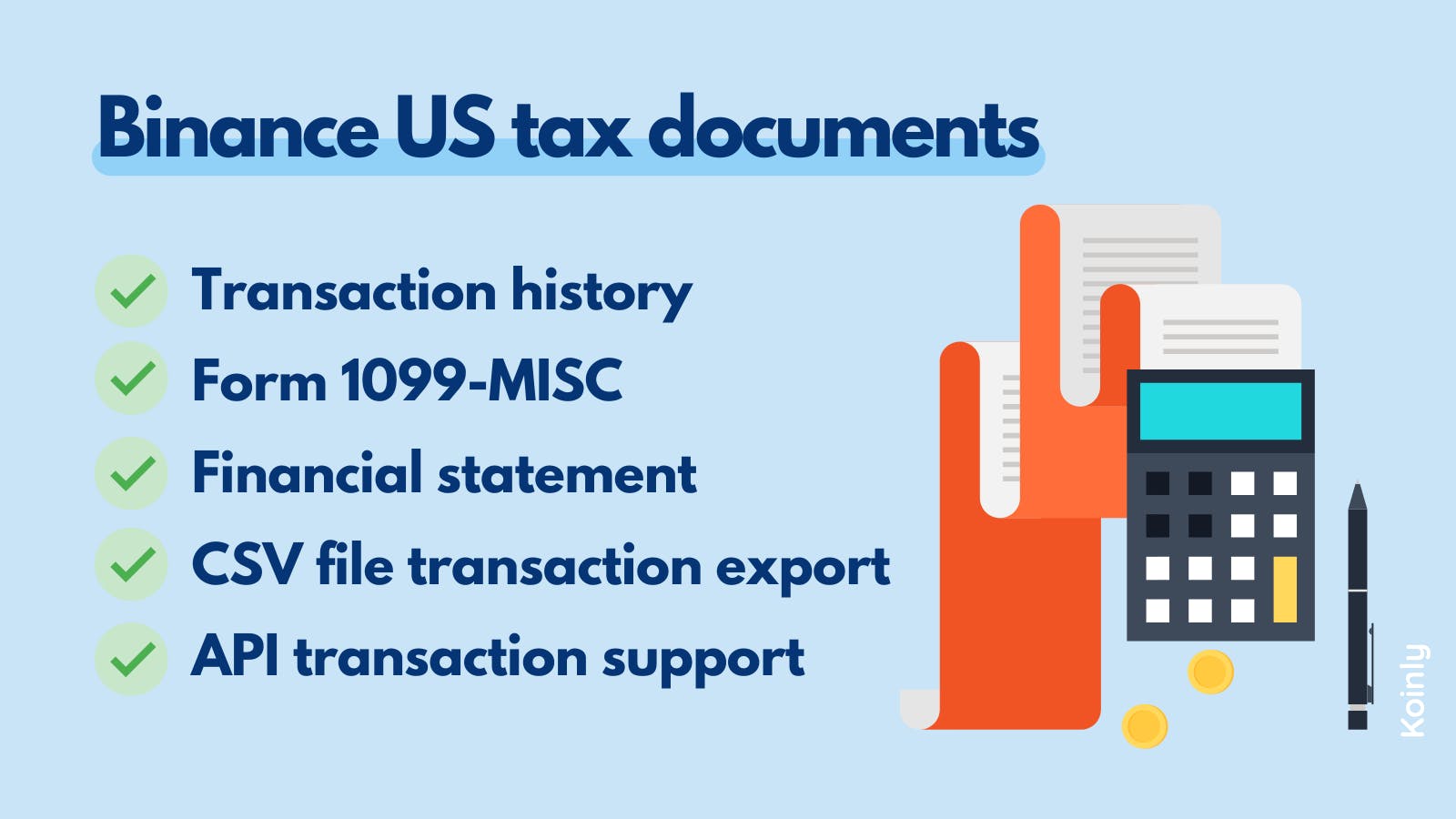

Yes BinanceUS sends Forms 1099-MISC to traders who have earned more than 600 on the platform from staking and rewards. Binance does not issue a 1099 form to its customers because it is not a US-based exchange and it no longer serves US.

3 Steps To Calculate Binance Taxes 2022 Updated

Upload your CSV or XLSX files here.

. Depending on the countrys regulatory framework when you trade commodities and the event produces capital gains or losses you would have to pay taxes duly. The API keys will automatically download your transaction history and keep your data in sync. What does the IRS do with the information BinanceUS provides.

Does BinanceUS report to the IRS. Capital losses may entitle you to a reduction in your tax bill. December 10 2021 - 2 min read.

Copy and paste your keys here. No they stopped issuing 1099-K s from 2021 so they dont report to the IRS. Firstly click on Account - API Management after logging into your Binance account.

Click on the link to view your API key and secret and then click Edit and uncheck Enable Trading. BinanceUS is making it easier for users to complete their tax returns by upgrading our tax reporting tool. We have integrated Binance via API on BearTax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes.

The last option is to manually add transactions one by one from the Transactions page. Binance allows exporting trades for a 3 month period at a time. You can also upload a CSVExcel file instead of connecting your account with public address by following the steps explained below.

How binance tax reporting works according to the irs crypto is treated as property for tax purposes so you are liable for any capital gains when you sell or trade it. Customers should do their own research to determine which platform works best for their specific needs. Filing cryptocurrency taxes can be complicated especially for those who are new to crypto.

You can use a ZenLedger to combine your tax report. Binance Tax Documents and Forms. Does Binance report to tax authorities.

If you use Bitcoin to pay for any type of good or service this will be counted as a taxable event and will incur a liability. Click on Export Complete Trade History at the top right corner. Binance does not provide tax or financial advice.

Simply follow the steps below to get your public address and your tax forms will be ready shortly. You will be emailed a link to confirm your API Key. This Form 1099-B that BinanceUS uses to report to the IRS in the future will contain detailed information about all cryptocurrency disposals on the platform.

However Binance US may comply with the US tax law and provide tax reports to the IRS. With Binance you are now able to have all your transactions tracked and accounted for automatically with our Tax Tool Functionality. Buying goods and services with crypto.

Here is a step by step procedure on how to get your tax info from Binance. Depending on the countrys tax framework when you trade commodities and the event produces capital gains or losses you may have to pay taxes. Koinly is a Binance tax calculator reporting tool.

Click on Create Tax Report API. For your Tax Report youll receive a unique API and Secret Key. Please note that BinanceUS does not endorse any tax and accounting platforms.

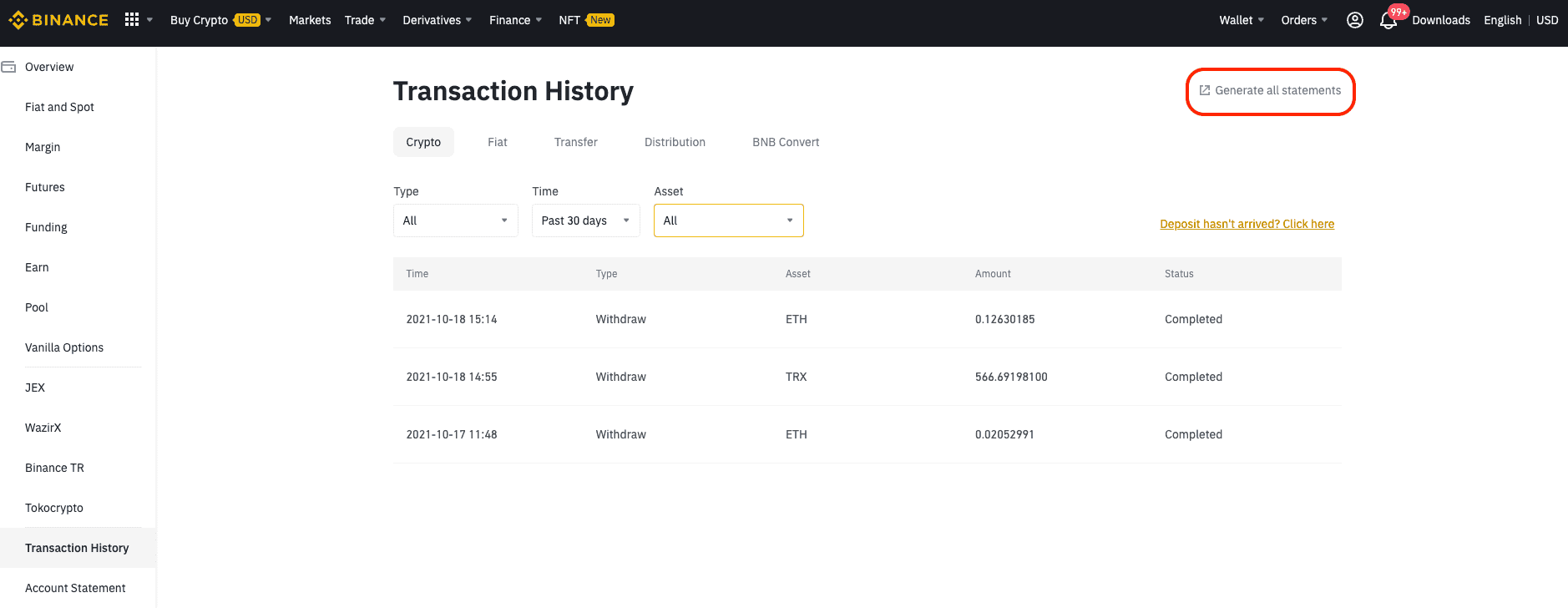

BinanceUS makes it easy to review your transaction history. Click Get code to receive a verification code to your email address. Name your API Key and click Create New Key button.

If your account meets both of the above criteria BinanceUS will send you a Form 1099-K in January 2021 to your accounts address of record. Imagine if Binance establishes partnership with us and has this capability in-built to send out tax forms directly to your email - that would be a great step towards. According to their website.

Go to the Binance API page by hovering over the user icon in the top header and then click API Management. At any time during 2020 did you receive sell send platform or otherwise acquire any financial interest in any. Previously BinanceUS took the position that it was a Third Party Settlement Organization TPSO under Section 6050W of the Internal Revenue Code and accordingly filed Forms 1099-K for certain transactions settled on the exchange.

Your tax forms will be ready soon. Tax consequences of Binances restructuring and Binanceus. BinanceUS Export Statement tool.

Meaning you will need to. In the past the IRS has used information from 1099 forms to send warning letters to. After you have the reports you can either fill in tax forms eg.

By law the exchange needs to keep extensive records of every transaction that takes place on the platform. Although it previously issued certain traders Forms 1099-K BinanceUS discontinued the practice in favor of the Form 1099-MISC for the 2021 tax year. This goes for ALL gains and lossesregardless if they are material or not.

The IRS states that US taxpayers are required to report gains and losses or income earned from crypto rewards based on certain thresholds on their annual tax return Form 1040. Binance does not provide tax advice. In this article well show you how you can prepare for the tax season and export your transaction history.

Once you have your API Tax Keys youll be able to connect your BinanceUS account to TaxBit and other third party platforms. Binance Tax Reporting You can generate your gains losses and income tax reports from your Binance investing activity by connecting your account with CoinLedger. The IRS will receive a duplicate copy of your Form 1099-K.

Binance is not a US-based exchange and it does not report anything to the IRS. How does cryptocurrency tax software help. Sign in to BinanceUS API Management.

1099 form on your own or send them to your tax account assistant. Now choose Create Tax Report API. Copy the API Key and Secret Key to.

BinanceUS will submit 1099-k tax forms to all qualified users US residents only. As tax offices around the world - including the IRS HMRC and the ATO - crack down on crypto you might be left with a lot of questions about your Binance taxes. One of the largest crypto exchanges worldwide - Binance helps millions of crypto investors buy sell and trade crypto every day.

Enter the verification code and your 2FA code if required then click Submit. File these crypto tax forms yourself send them to your tax professional or import them into your preferred tax filing software like TurboTax or TaxAct. Yes Binance does provide tax info but you need to understand what this entails.

Does Binance Us Report To The Irs

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

How The Irs Knows You Owe Crypto Bitcoin Taxes Cointracker

Binance Tax Reporting How To Do It Ultimate Guide By Cryptogeek

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Does Binance Us Report To The Irs

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

3 Steps To Calculate Binance Taxes 2022 Updated

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

How To Do Your Binance Us Taxes Koinly

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

How To Do Your Binance Us Taxes Koinly

How To Do Your Binance Us Taxes Koinly