will capital gains tax rate increase in 2021

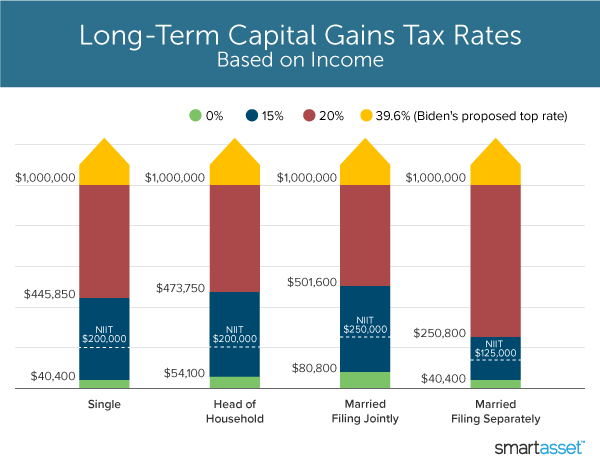

Long-term capital gains and qualified dividends of taxpayers with adjusted gross income AGI of more than 1 million would be taxed at ordinary income tax rates of up to 396 but with a rate of 434 if you include the net investment income tax. The tax rate on these gains ranges from 0 to 20 depending on your annual taxable income.

2022 Capital Gains Tax Rates In Europe Tax Foundation

PoolGetty Images Capital gains tax is.

. Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021. In contrast short-term capital gains are taxed as normal income which can be a much higher rate. Capital Gains and Dividend Rates.

But the truth is raising the capital gains tax rate wont hurt the economy or cut investments at all. On December 31 2026 the taxpayer will receive a 100000 10 step-up in basis so the 28 capital gains tax rate will be applied to 900000 of the deferred gain. However which one of those long-term capital gains rates 0 15 or 20 applies to you depends on your taxable income.

Apr 23 2021 305 AM Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said. The higher your income the higher the rate. If youre working on your.

Assume the Federal capital gains tax rate in 2026 becomes 28. However theyll pay 15 percent on capital gains if. In the US short-term capital gains are taxed as ordinary income.

That means you could pay up to 37 income tax depending on your federal income tax bracket. Short-Term Capital Gains Tax Rates 2021. The long-term capital gains tax rate varies between 0 15 and 20.

In fact Bidens plan to raise the capital gains. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. Ad Find Deals on turbo tax online in Software on Amazon.

For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Capital gains currently subject to a 20 percent tax for individuals earning more than 441450 may also be subject to the 38 percent net investment income tax.

President Bidens team released details related to the American Families Plan. Use our no-cost income tax calculator to get a quick estimate of what you will owe the federal government. While it is unknown what the final legislation may contain the elimination of a rate increase on capital gains in the draft legislation is encouraging.

Single taxpayers and those who are married and filing separate returns wont pay a capital gains tax if their income was 40400 in 2021 increasing to 41675 in 2022. All Major Categories Covered. Its time to increase taxes on capital gains Posted on January 7 2021 by Michael Smart Michael Smart To address wealth inequality and to improve functioning of our tax system tax rates on capital gains income should be increased.

Your 2021 Tax Bracket to See Whats Been Adjusted. Capital gains tax could double in 2021 or 2022. But because the higher tax rate as proposed would only impact.

The current tax preference for capital gains costs upwards of 15 billion annually. Income tax rates vary between 12 and 37. Up to 19900.

There are a few higher rates for particular items but they dont apply to a home sale. 2021 Federal Income Tax Brackets. The Wall Street Journal reports.

President Bidens expected 6 trillion budget assumes that his proposed capital-gains tax rate increase took effect in late April meaning that it would already be too late for high-income investors to realize gains at the lower tax rates if Congress agrees according to two people familiar with the proposal. So the rate of taxation increases as income increases. How much tax do you pay on capital gains.

2021 Capital Gains Tax Rate Thresholds Tax on Net Investment Income Theres an additional 38 surtax on net investment income NII that you might have to pay on top of the capital gains tax. On April 28 2021 President Biden released the American Families Plan which included a proposal to increase the long-term capital gains tax rate for households with income exceeding 1 million to 396 from the current 20 tax rate. Most singles will fall into the 15 capital gain rate which applies to income between 40401 and 445850.

Long-term capital gains assets held for more than one year are taxed at 0 for taxpayers in the 10 and 15 tax brackets and 15 for taxpayers in the 25 28 33 and 35 tax brackets. It would be very surprising to see the capital gains rate go higher than 28. Married couples filing jointly.

The proposal would increase the maximum stated capital gain rate from 20 to 25. For one-time contributions you may qualify for a zero percent capital gain rate if you have an income of less than 40400 in 2021. Individuals with over 445850 will be affected by the 20 long-term capital gain rate.

Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. At the end of this post I share a free calculator that will show you the cost difference. Currently the top federal tax rate is 238 and could jump to 434 under the latest tax proposal.

The threshold is slightly higher for heads of household and twice as much for. Or sold a home this past year you might be wondering how to avoid tax on capital gains. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021.

Ad Compare Your 2022 Tax Bracket vs. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. Discover Helpful Information and Resources on Taxes From AARP.

In fact recent intelligence suggests many Democrats favor a rate increase as low as 42 percentage points which would result in a 242 rate before net investment income NII tax and a 28 rate inclusive of the 38 NII tax. Select Popular Legal Forms Packages of Any Category. Ad If youre one of the millions of Americans who invested in stocks.

The effective date for this increase would be September 13 2021. The top rate would be 288 when. And under the latest tax legislation the long term capital gains rate for those in the 396 tax bracket rose to 20.

And for those earning over 1 million the capital gains tax could jump to a whopping 408 percent if certain changes are adopted financial advisors are saying.

The Tax Impact Of The Long Term Capital Gains Bump Zone

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

What S In Biden S Capital Gains Tax Plan Smartasset

Exemption From Capital Gains On Debt Funds Paisabazaar Com

How High Are Capital Gains Taxes In Your State Tax Foundation

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

The Tax Impact Of The Long Term Capital Gains Bump Zone

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

The Tax Impact Of The Long Term Capital Gains Bump Zone

2022 And 2021 Capital Gains Tax Rates Smartasset

2022 Capital Gains Tax Rates By State Smartasset

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

The Tax Impact Of The Long Term Capital Gains Bump Zone

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)